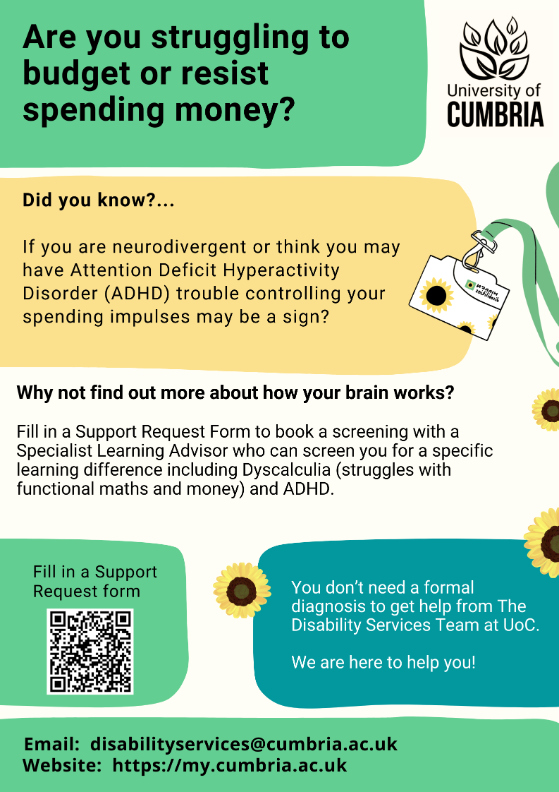

If you are worrying about debt, it can be hard to know where to go. Take pressure off yourself and ask for free and confidential advice from a money advisor. Book an appointment using the Student Enquiry Point (StEP). Seeking advice does not affect your credit score and may help you feel less stressed and more in control of your life.

There is no obligation to follow their advice but support is free and can help provide an objective opinion on your situation.

Further external information can be found be found online by clicking the links to these various organisations.

Citizens Advice offer phone support and face-to-face help for anyone who may need it. Find one of their advice centres to arrange an in person appointment.

Find our more about their online chat and phone support with a follow-up service.

Here you can access the online chat and phone support with a follow-up service.

Christians Against Poverty (CAP)

You don't have to be a Christian to access this service. Christians Against Poverty can offer face-to-face services and help with debt and the emotional issues surrounding it.