Creating a student budget, using an online budgeting tool or app will help you to keep track of your income and outgoings. Work out how much you spend and create a list of wants and needs. This will help you to prioritise your essential costs and look at ways to reduce your spending on non-essential items such as memberships or subscriptions. Changing habits can be challenging but the savings can be rewarding, the Money Saving Expert ‘Demotivator’ is a fun tool to help you cut back and save.

If you are not sure where to begin, have a look at the online budget tools from the Money Saving Expert website or Save the Student which includes a thorough budget planner and guide.

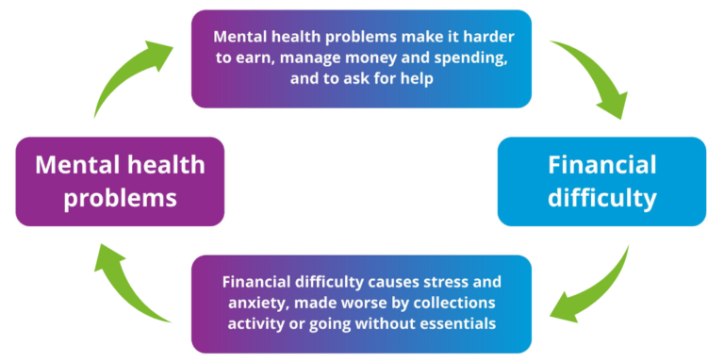

The rise in the cost of living has been in the news a lot recently, along with the pandemic, many students may be feeling anxious about how this will affect them whilst studying

The rise in the cost of living has been in the news a lot recently, along with the pandemic, many students may be feeling anxious about how this will affect them whilst studying